When choosing a depository institution, the three most important things to look for are reliability, convenience, and trustworthiness. Reliability ensures your funds are safe and accessible when needed. Convenience is key for easy transactions and account management. Trustworthiness is vital in maintaining a long-term relationship with a secure financial partner. Prioritizing these factors will help you make informed decisions about your banking needs. What would be the three most important things you would look for in a depository institution? It all starts with these essential pillars of a sound banking experience.

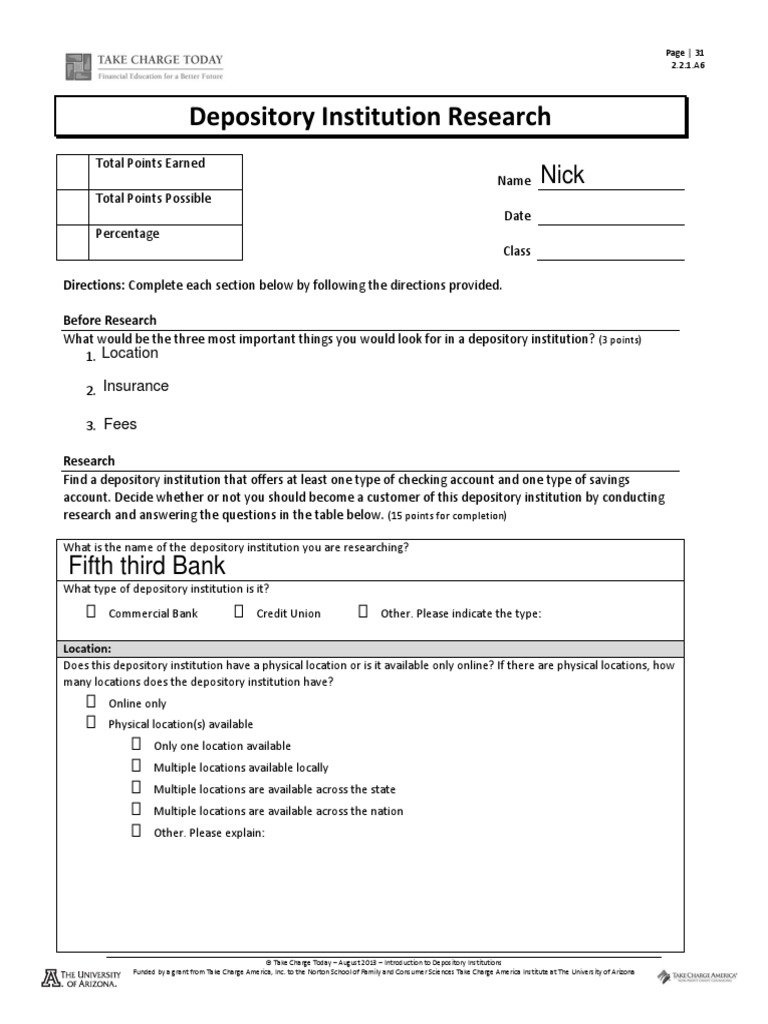

What Would Be the Three Most Important Things You Would Look for in a Depository Institution?

Introduction: Exploring Depository Institutions

When it comes to managing your money, finding the right depository institution is crucial. Depository institutions are where you can securely deposit your money, access various financial services, and potentially grow your savings. But with so many options out there, it’s essential to know what to look for when choosing a depository institution.

The Importance of Choosing the Right Depository Institution

A depository institution is a financial institution that accepts and manages deposits from individuals and organizations. These institutions play a vital role in the economy by providing a safe place for people to store their money, access credit, and facilitate the flow of funds in the financial system. When deciding where to entrust your hard-earned money, there are three key factors you should consider.

1. Safety and Security

The first and most crucial factor to consider when choosing a depository institution is safety and security. You want to ensure that your money is protected and that the institution is reliable. One way to assess the safety of a depository institution is by checking if it is insured by a reputable organization like the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA).

FDIC Insurance: Your Safety Net

The FDIC is an independent agency of the United States government that protects depositors against the loss of their deposits if an FDIC-insured bank or savings institution fails. When a bank is FDIC-insured, it means that your deposits are protected up to a certain amount, typically $250,000 per depositor, per ownership category.

NCUA Insurance for Credit Unions

If you are considering a credit union instead of a traditional bank, look for the NCUA insurance logo. The NCUA operates similarly to the FDIC but specifically for credit unions. Having NCUA insurance provides the same level of protection for your deposits in a credit union as FDIC insurance does for banks.

2. Fees and Costs

Another critical factor to consider when choosing a depository institution is the fees and costs associated with maintaining an account. Different institutions may have varying fee structures, so it’s essential to understand what you will be charged for services like monthly account maintenance, ATM withdrawals, overdrafts, and wire transfers.

Understanding Fee Structures

Before opening an account, make sure to review the institution’s fee schedule carefully. Some institutions offer accounts with no monthly maintenance fees if certain requirements are met, such as maintaining a minimum balance or setting up direct deposit. Be aware of overdraft fees, ATM fees for using out-of-network ATMs, and any other potential charges that may apply to your account.

Comparing Fee Structures

To ensure you are getting the best deal, consider comparing fee structures across different depository institutions. Look for accounts that align with your financial habits and offer services with minimal fees. Some institutions may even waive certain fees for students, seniors, or military personnel, so be sure to inquire about any available discounts.

3. Convenience and Accessibility

The third important factor to consider when choosing a depository institution is convenience and accessibility. You want to select an institution that makes it easy for you to manage your money, access your accounts, and conduct transactions seamlessly.

Branch Locations and ATMs

Consider the location of branch offices and ATMs when choosing a depository institution. If you prefer conducting in-person transactions, having a branch nearby can be convenient. Similarly, easy access to ATMs can help you avoid out-of-network ATM fees. Some institutions are part of nationwide ATM networks, providing you with a wide network of surcharge-free ATMs.

Online and Mobile Banking Services

In today’s digital age, online and mobile banking services are essential for many consumers. Check if the institution offers a user-friendly online banking platform and a mobile app that allows you to check your balance, transfer funds, pay bills, and deposit checks remotely. These digital services can enhance your banking experience and save you time.

In conclusion, when considering what to look for in a depository institution, prioritize safety and security, fees and costs, and convenience and accessibility. By selecting an institution that offers FDIC or NCUA insurance, transparent fee structures, and convenient banking services, you can make managing your finances easier and more efficient. Take the time to research various institutions, compare their offerings, and choose the one that best fits your financial needs and preferences. Remember, the right depository institution can help you achieve your financial goals and provide peace of mind knowing that your money is in good hands.

The Basics of Investing (Stocks, Bonds, Mutual Funds, and Types of Interest)

Frequently Asked Questions

What factors should I consider when choosing a depository institution to open an account?

When selecting a depository institution, it is essential to look for factors such as the institution’s reputation, fees and account requirements, and the range of services offered. A good reputation indicates trustworthiness and stability. Understanding the fees and account requirements can help you avoid unexpected charges and find an account that suits your financial needs. Additionally, assessing the available services like online banking, mobile apps, and customer support can enhance your banking experience.

How important is the safety and security of funds when evaluating depository institutions?

The safety and security of funds are paramount considerations when evaluating depository institutions. Look for institutions that are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA) to ensure your deposits are protected. Additionally, check for security measures such as encryption protocols for online transactions and multi-factor authentication to protect your account from unauthorized access and fraud.

Why is the convenience of location and access important when choosing a depository institution?

Convenience of location and access play a crucial role in the decision-making process when selecting a depository institution. Choose an institution with branches or ATMs in locations that are easily accessible to you to facilitate cash deposits, withdrawals, and in-person assistance when needed. Moreover, consider digital banking options like online banking and mobile apps that offer convenience in managing your accounts anytime, anywhere.

Final Thoughts

When choosing a depository institution, prioritize safety, fees, and convenience. Safety ensures your funds are secure, while low fees can help you save money in the long run. Additionally, convenience plays a crucial role in accessibility to your accounts. Consider these factors when deciding where to trust your money.